Spatial Data

Mining in Geo-Business

Joseph K, Berry 1

W. M. Keck Visiting Scholar

in Geosciences, Geography,

Principal, Berry &

Associates // Spatial Information Systems (BASIS),

Email: jberry@innovativegis.com; Website: www.innovativegis.com

Kenneth L. Reed 2

Xtreme Data

Mining, Costa Mesa,

This paper was presented at GeoTec, June 2-5, 2008, Ottawa,

Ontario, Canada

Paper available online at http://www.innovativegis.com/basis/present/GeoTec08/ —

click for a printer-friendly .pdf version —

PowerPoint .ppt slide set

Abstract

Most traditional Geo-business applications force spatial

information, such as customer location, to be aggregated into large generalized

reporting units. More recently targeted

marketing, retail trade area analysis, competition analysis and predictive

modeling provide examples applying sophisticated spatial analysis and

statistics to improve decision making and ensure sound business decisions. This paper describes a spatial data mining

process for generating predicted sales maps for various products within a large

metropolitan area. The discussion identifies

the processing steps involved in compiling a spatially-aware customer database

and then applying CART technology for analyzing relative travel-time advantage

coupled with existing customer data to derive information on travel-time

sensitivity and sales patterns. The

conceptual keystone of this application is the concept of a grid-based analytic

frame and its continuous map surfaces that underwrite the spatially aware

database. The column, row index of the

grid cells in the matrix is appended to each record the database and serves as

a primary key for cross-walking information between the

Twisting the Perspective of Map Surfaces

Traditionally one thinks of a

map surface in terms of a postcard scene of the

However, a geomorphological

point of view of a digital elevation model (DEM) isn’t the only type of map

surface. For example, a Customer Density Surface can be derived

from sales data that depicts the peaks and valleys of customer concentrations

throughout a city as discussed in an earlier Beyond Mapping column (November

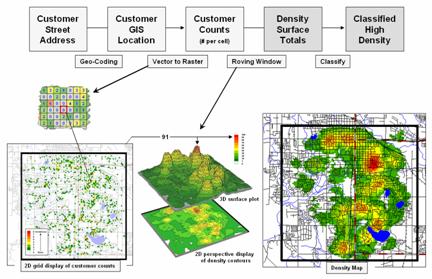

2005; see author’s note). Figure 1

summarizes the processing steps involved—1) a customer’s street address is

geocoded to identify its Lat/Lon coordinates, 2) vector to raster conversion is

used to place and aggregate the number of customers in each grid cell of an

analysis frame (discrete mapped data),

3) a rowing window is used to count the total number of customers within a

specified radius of each cell (continuous

mapped data), and then 4) classified into logical ranges of customer density.

The important thing to note

is that the peaks and valleys characterize the Spatial Distribution of the customers, a concept closely akin to a Numerical Distribution that serves as

the foundation for traditional statistics.

However in this instance, three dimensions are needed to characterize

the data’s dispersion—X and Y coordinates to position the data in geographic

space and a Z coordinate to indicate the relative magnitude of the variable (#

of customers). Traditional statistics

needs only two dimensions—X to identify the magnitude and Y to identify the

number of occurrences.

Figure 1. Geocoding can be used to connect customer

addresses to their geographic locations for subsequent map analysis, such as generating a map

surface of customer density.

While both perspectives track

the relative frequency of occurrence of the values within a data set, the spatial

distribution extends the information to variations in geographic space, as well

as in numerical variations in magnitude— from just “what” to “where is

what.” In this case, it describes the

geographic pattern of customer density as peaks (lots of customers nearby) and

valleys (not many).

Within our historical

perspective of mapping the ability to plot “where is what” is an end in

itself. Like Inspector Columbo’s crime

scene pins poked on a map, the mere visualization of the pattern is thought to

be sufficient for solving crimes.

However, the volume of sales transactions and their subtle relationships

are far too complex for a visual (visceral?) solution using just a Google Earth

mashed-up image.

The interaction of numerical

and spatial distributions provides fertile turf for a better understanding of

the mounds of data we inherently collect every day. Each credit card swipe identifies a basket of

goods and services purchased by a customer that can place on a map for

grid-based map analysis to make sense of it all—“why” and “so what.”

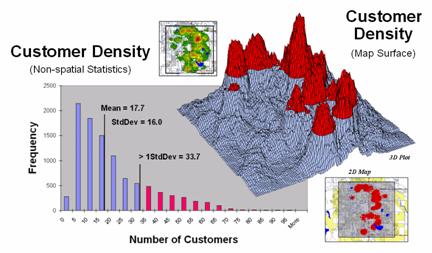

Figure 2. Merging traditional statistics and map

analysis techniques increases understanding of spatial patterns and

relationships (variance-focused; continuous) beyond the usual central tendency

(mean-focused; scalar) characterization of geo-business data.

For example, consider the

left side of figure 2 that relates the unusually high response range of

customers of greater than 1 standard deviation above the mean (a numerical

distribution perspective) to the right side that identifies the location of

these pockets of high customer density (a spatial distribution perspective). As discussed in a previous Beyond Mapping

column (May 2002; see author’s note), this simple analysis uses a typical

transaction database to 1) map the customer locations, 2) derive a map surface

of customer density, 3) identify a statistic for determining unusually high

customer concentrations (> Mean + 1SD), and 4) apply the statistic to locate

the areas with lots of customers. The

result is a map view of a commonly used technique in traditional statistics—an

outcome where the combined result of an integrated spatial and numerical

analysis is far greater than their individual contributions.

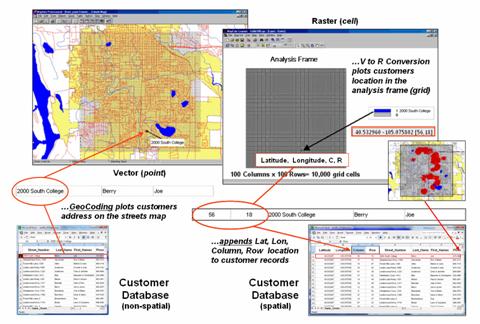

Figure 3. The column, row index of the grid cells in the

analytic frame serves as a primary key for linking spatial analysis results

with individual records in a database.

However, another step is

needed to complete the process and fully illustrate the geo-business

framework. The left side of figure 3 depicts

the translation of a non-spatial customer database into a mapped representation

using vector-based processing that determines Lat/Lon coordinates for each

record—the mapping component.

Translation from vector to raster data structure establishes the analytic

frame needed for map analysis, such as generating a customer density surface

and classifying it into statistically defined pockets of high customer

density—then map analysis component.

The importance of the

analytic frame is paramount in the process as it provides the link back to the

original customer database—the spatial data mining component. The column, row index of the matrix for each

customer record is appended to the database and serves as a primary key for

“walking” between the

Similarly, maps of demographics,

sales by product, travel-time to our store, and the like can be used in

customer segmentation and propensity modeling to identify maps of future sales

probabilities. Areas of high probability

can be cross-walked to an existing customer database (or zip +4 or other

generic databases) to identify new sales leads, product mix, stocking levels,

inventory management and competition analysis.

At the core of this vast potential for geo-business applications are the

analytic frame and its continuous map surfaces that underwrite a spatially

aware database.

Linking Numeric and Geographic Distributions

Another grid-based technique

for investigating customer patterns involves

Figure 4. Clustering on the latitude and longitude

coordinates of point locations can be used to identify geographically balanced

customer territories.

The two small inserts on the

left show the general pattern of customers, and then the partitioning of the

pattern into spatially balanced groups.

This initial step was achieved by applying a K-means clustering

algorithm to the latitude and longitude coordinates of the customer

locations. In effect this procedure

maximizes the differences between the groups while minimizing the differences

within each group. There are several

alternative approaches that could be applied, but K-means is an often-used

procedure that is available in all statistical packages and a growing number of

GIS systems.

The final step to assign

territories uses a nearest neighbor interpolation algorithm to assign

all non-customer locations to the nearest customer group. The result is the customer territories map shown

on the right. The partitioning based on

customer locations is geographically balanced (approximately the same area in

each cluster), however it doesn’t consider the number of customers within each

group—that varies from 69 in the lower right (Territory #8) to 252 (Territory

#5) near the upper right… that twist of map analysis will be tackled in a

future beyond mapping column.

However it does bring up an

opportunity to discuss the close relationship between spatial and non-spatial

statistics. Most of us are familiar with

the old “bell-curve” for school grades.

You know, with lots of C’s, fewer B’s and D’s, and a truly select set of

A’s and F’s. Its shape is a perfect bell,

symmetrical about the center with the tails smoothly falling off toward less

frequent conditions.

However the normal distribution (bell-shaped) isn’t as normal (typical) as

you might think. For example, Newsweek noted that the average grade at

a major ivy-league university isn’t a solid C with a few A’s and F’s sprinkled

about as you might imagine, but an A- with a lot of A’s trailing off to lesser

amounts of B’s, C’s and (heaven forbid) the very rare D or F.

The frequency distributions

of mapped data also tend toward the ab-normal

(formally termed asymmetrical). For example, consider the customer density

data shown in the figure 5 that was derived by counting the total number of

customers within a specified radius of each cell (roving window). The geographic distribution of the data is

characterized in the Map View by the 2D contour map and

3D surface on the left. Note the

distinct pattern of the terrain with bigger bumps (higher customer density) in

the central portion of the project area.

As is normally the case with mapped data, the map values are neither

uniformly nor randomly distributed in geographic space. The unique pattern is the result of complex

spatial processes determining where people live that are driven by a host of

factors—not spurious, arbitrary, constant or even “normal” events.

Figure 5. Mapped data are

characterized by their geographic distribution (maps on the left) and their

numeric distribution (descriptive statistics and histogram on the right).

Now turn your attention to

the numeric distribution of the data depicted in the right side of the

figure. The Data View was generated

by simply transferring the grid values in the analysis frame to Excel, then

applying the Histogram and Descriptive Statistics options of the

Data Analysis add-in tools. The map

organizes the data as 100 rows by 100 columns (X,Y) while the non-spatial view

simply summarizes the 10,000 values into a set of statistical indices

characterizing the overall central tendency of the data. The mechanics used to plot the histogram and

generate the statistics are a piece-of-cake, but the real challenge is to make

some sense of it all.

Note that the data aren’t

distributed as a normal bell-curve, but appear shifted (termed skewed) to the

left. The tallest spike and the

intervals to its left, match the large expanse of grey values in the map

view—frequently occurring low customer density values. If the surface contained a disproportionably

set of high value locations, there would be a spike at the high end of the

histogram. The red line in the histogram

locates the mean (average) value for the numeric distribution. The red line in the 3D map surface shows the

same thing, except its located in the geographic distribution.

The mental exercise linking geographic space with data space is a good one, and

some general points ought to be noted.

First, there isn’t a fixed relationship between the two views of the

data’s distribution (geographic and numeric).

A myriad of geographic patterns can result in the same histogram. That’s because spatial data contains

additional information—where, as well

as what—and the same data summary of

the “what’s” can reflect a multitude of spatial arrangements (“where’s”).

But is the reverse true? Can a given geographic

arrangement result in different data views?

Nope, and it’s this relationship that catapults mapping and geo-query

into the arena of mapped data analysis.

Traditional analysis techniques assume a functional form for the

frequency distribution (histogram shape), with the standard normal

(bell-shaped) being the most prevalent.

Spatial statistics, the

foundation of geo-business applications, doesn’t predispose any geographic or

numeric functional forms—it simply responds to the inherent patterns and

relationships in a data set. The next

several sections will describe some of the surface modeling and spatial data

mining techniques available to the venturesome few who are willing to work

“outside the lines” of traditional mapping and statistics.

Interpolating Spatial Distributions

Statistical sampling has long

been at the core of business research and practice. Traditionally data analysis used non-spatial

statistics to identify the “typical” level of sales, housing prices, customer

income, etc. throughout an entire neighborhood, city or region. Considerable effort was expended to determine

the best single estimate and assess just how good the “average” estimate was in

typifying the extended geographic area.

However non-spatial

techniques fail to make use of the geographic patterns inherent in the data to

refine the estimate—the typical level is assumed everywhere the same throughout

a project area. The computed variance

(or standard deviation) indicates just how good this assumption is—the larger

the standard deviation, the less valid is the assumption “everywhere the same.” But no

information is provided as to where values might be more or less than the

computed typical value (average).

Spatial Interpolation, on the other hand, utilizes spatial patterns in a

data set to generate localized estimates throughout the sampled area. Conceptually it “maps the variance” by using geographic position to help explain the

differences in the sample values. In

practice, it simply fits a continuous surface (kind of like a blanket) to the

point data spikes (figure 6).

Figure 6. Spatial

interpolation involves fitting a continuous surface to sample points.

While the extension from

non-spatial to spatial statistics is a theoretical leap, the practical steps

are relatively easy. The left side of

figure 1 shows 2D and 3D “point maps” of data samples depicting the percentage

of home equity loan to market value.

Note that the samples are geo-referenced and that the sampling

pattern and intensity

are different than those generally used in traditional non-spatial statistics

and tend to be more regularly spaced and numerous.

The surface map on the right

side of figure 6 translates pattern of the “spikes” into the peaks and valleys

of the surface map representing the data’s spatial distribution. The traditional, non-spatial approach when

mapped is a flat plane (average everywhere) aligned within the yellow

zone. Its “everywhere the same”

assumption fails to recognize the patterns of larger levels (reds) and smaller

levels (greens). A decision based on the

average level (42.88%) would be ideal for the yellow zone but would likely be

inappropriate for most of the project area as the data vary from 16.8 to 72.4

percent.

The process of converting

point-sampled data into continuous map surfaces representing a spatial

distribution is termed Surface Modeling

involving density analysis and map generalization (discussed last month), as

well as spatial interpolation techniques.

All spatial interpolation techniques establish a "roving

window" that—

- moves to a grid location in a project area

(analysis frame),

- calculates an estimate based on the point samples

around it (roving window),

- assigns the estimate to the center cell of the

window, and then

- moves to the next grid location.

The extent of the window

(both size and shape) affects the result, regardless of the summary

technique. In general, a large window capturing a larger number of values

tends to "smooth" the data. A smaller window tends to result in

a "rougher" surface with more abrupt transitions.

Three factors affect the

window's extent: its reach, the number of samples, balancing. The reach,

or search radius, sets a limit on how far the computer will go in collecting

data values. The number of samples establishes how many data

values should be used. If there is more than the specified number of

values within a specified reach, the computer uses just the closest ones.

If there are not enough values, it uses all that it can find within the

reach. Balancing of the data

attempts to eliminate directional bias by ensuring that the values are selected

in all directions around window's center.

Figure 7. Inverse distance weighted interpolation

weight-averages sample values within a roving window.

The right portion of figure 7

contains three-dimensional (3-D) plots of the point sample data and the inverse

distance-squared surface generated. The estimated value in the example

can be conceptualized as "sitting on the surface," 53.35 units above

the base (zero).

Figure 8 shows the weighted

average calculations for spatially interpolating the example location in figure

7. The Pythagorean Theorem is used to

calculate the Distance from the Grid

Location to each of the data Samples

within the summary window. The distances

are converted to Weights that are

inversely proportional (1/D2; see example calculation in the

figure). The sample Values are multiplied by their computed Weights and the “sum of the products” is divided by the “sum of the

weights” to calculate the weighted average value (53.35) for the location on

the interpolated surface.

Figure 8. Example Calculations for Inverse Distance

Squared Interpolation.

Because the inverse distance

procedure is a fixed, geometric-based method, the estimated values can never

exceed the range of values in the original field data. Also, IDW tends to

"pull-down peaks and pull-up valleys" in the data, as well as

generate “bull’s-eyes” around sampled locations. The technique is best

suited for data sets with samples that exhibit minimal regional trends.

However, there are numerous

other spatial interpolation techniques that map the spatial distribution

inherent in a data set. Next month’s

column will focus on benchmarking interpolation results from different

techniques and describe a procedure for assessing which is best.

Interpreting Interpolation Results

For some, the previous

discussion on generating map surfaces from point data might have been too simplistic—enter

a few things then click on a data file and, viola, you have a equity

loan percentage surface artfully displayed in 3D with a bunch of cool

colors.

Actually, it is that easy to

create one. The harder part is figuring

out if the map generated makes sense and whether it is something you ought to

use in analysis and important business decisions. This month’s column discusses the relative

amounts of information provided by the non-spatial arithmetic average versus

site-specific maps by comparing the average and two different interpolated map

surfaces. The discussion is further

extended to describe a procedure for quantitatively assessing interpolation

performance.

The top-left inset in figure

9 shows the map of the loan data’s average. It’s not very exciting and looks

like a pancake but that’s because there isn’t any information about spatial

variability in an average value—it assumes 42.88 percent is everywhere. The non-spatial estimate simply adds up all

of the sample values and divides by the number of samples to get the average

disregarding any geographic pattern.

The spatially-based estimates

comprise the map surface just below the pancake. As described last month, Spatial Interpolation looks at the relative positioning of the

samples values as well as their measure of loan percentage. In this instance the big bumps were

influenced by high measurements in that vicinity while the low areas responded

to surrounding low values.

The map surface in the right

portion of figure 9 compares the two maps by simply subtracting them. The colors were chosen to emphasize the

differences between the whole-field average estimates and the interpolated

ones. The thin yellow band indicates no

difference while the progression of green tones locates areas where the

interpolated map estimated higher values than the average. The progression of red tones identifies the

opposite condition with the average estimate being larger than the interpolated

ones.

Figure 9. Spatial

comparison of the project area average and the IDW interpolated surface.

The difference between the

two maps ranges from –26.1 to +29.5. If

one assumes that a difference of +/- 10 would not significantly alter a

decision, then about one-quarter of the area (9.3+1.4+11= 21.7%) is adequately

represented by the overall average of the sample data. But that leaves about three-fourths of the

area that is either well-below the average (18 + 19 = 37%) or well-above (25+17

= 42%). The upshot is that using the

average value in either of these areas could lead to poor decisions.

Now turn your attention to

figure 10 that compares maps derived by two different interpolation techniques—IDW

(inverse distance weighted) and Krigging (an advanced spatial statistics

technique using data trends). Note the

similarity in the two surfaces; while subtle differences are visible, the

overall trend of the spatial distribution is similar.

Figure 10.

Spatial comparison of IDW and Krig interpolated surfaces.

The difference map on the

right confirms the similarity between the two map surfaces. The narrow band of yellow identifies areas

that are nearly identical (within +/- 1.0).

The light red locations identify areas where the IDW surface estimates a

bit lower than the Krig ones (within -10); light green a bit higher (within

+10). Applying the same assumption about

“plus/minus 10 difference” being negligible for decision-making, the maps are

effectively the same (99.0%).

So what’s the bottom

line? First, that there are substantial

differences between an arithmetic average and interpolated surfaces. Secondly, that quibbling about the best

interpolation technique isn’t as important as using any interpolated surface

for decision-making.

But which surface best

characterizes the spatial distribution of the sampled data? The answer to this question lies in Residual

Analysis—a technique that investigates the differences between estimated

and measured values throughout an area.

The table in figure 11

reports the results for twelve randomly positioned test samples. The first column identifies the sample ID and

the second column reports the actual measured value for that location. Column C simply depicts the assumption that

the project area average (42.88) represents each of the test locations. Column D computes the difference of the

“estimate minus actual”—formally termed the residual. For example, the first test point (ID#1)

estimated the average of 42.88 but was actually measured as 55.2, so -12.32 is

the residual (42.88 - 55.20= -12.32) …quite a bit off. However, point #6 is a lot better (42.88-49.40=

-6.52).

Figure 11. A residual analysis table identifies the

relative performance of average, IDW and Krig estimates.

The residuals for the IDW and

Krig maps are similarly calculated to form columns F and H, respectively. First note that the residuals for the project

area average are considerably larger than either those for the IDW or Krig

estimates. Next note that the residual

patterns between the IDW and Krig are very similar—when one is off, so is the

other and usually by about the same amount.

A notable exception is for test point #4 where the IDW estimate is

dramatically larger.

The rows at the bottom of the

table summarize the residual analysis results.

The Residual Sum characterizes

any bias in the estimates—a negative value indicates a tendency to

underestimate with the magnitude of the value indicating how much. The –20.54 value for the whole-field average

indicates a relatively strong bias to underestimate.

The Average Error reports how typically far off the estimates

were. The 16.91 figure for area average

is about ten times worse than either IDW (1.73) or Krig (1.31). Comparing the figures to the assumption that

a plus/minus10 difference is negligible in decision-making, it is apparent that

1) the project area average is inappropriate and that 2) the accuracy

differences between IDW and Krig are very minor.

The Normalized Error simply calculates the average error as a

proportion of the average value for the test set of samples (1.73/44.59= 0.04

for IDW). This index is the most useful

as it allows you to compare the relative map accuracies between different

maps. Generally speaking, maps with

normalized errors of more than .30 are suspect and one might not want to use them

for important decisions.

So what’s the bottom-bottom

line? That Residual Analysis is an

important component of geo-business data analysis. Without an understanding of the relative

accuracy and interpolation error of the base maps, one cannot be sure of the

recommendations and decisions derived from the interpolated data. The investment in a few extra sampling points

for testing and residual analysis of these data provides a sound foundation for

business decisions. Without it, the

process becomes one of blind faith and wishful thinking with colorful maps.

Characterizing Data Groups

One of the most fundamental techniques in map

analysis is the comparison of a set of maps.

This usually involves staring at some side-by-side map displays and

formulating an impression about how the colorful patterns do and don’t appear

to align.

But just how similar is one location to

another? Really similar, or just a

little bit similar? And just how

dissimilar are all of the other areas?

While visual (visceral?) analysis can identify broad relationships, it

takes quantitative map analysis to generate the detailed scrutiny demanded by

most Geo-business applications.

Consider the three maps shown in figure 12— what

areas identify similar data patterns? If

you focus your attention on a location in the southeastern portion, how similar

are all of the other locations? Or how

about a northeastern section? The

answers to these questions are far too complex for visual analysis and

certainly beyond the geo-query and display procedures of standard desktop

mapping packages.

The mapped data in the example show the geographic

patterns of housing density, value and age for a project area. In visual analysis you move your focus among

the maps to summarize the color assignments (2D) or relative surface height

(3D) at different locations. In the

southeastern portion the general pattern appears to be low Density, high Value

and low Age— low, high, low. The

northeastern portion appears just the opposite—high, low, high.

The difficulty in visual analysis is two-fold—

remembering the color patterns and calculating the difference. Quantitative map analysis does the same thing

except it uses the actual map values in place of discrete color bands. In addition, the computer doesn’t tire as

easily as you and completes the comparison throughout an entire map window in a

second or two (10,000 grid cells in this example).

Figure 12. Map surfaces identifying the spatial

distribution of housing density, value and age.

The upper-left portion of figure 13 illustrates

capturing the data patterns for comparing two map locations. The “data spear” at Point #1 identifies the

housing Density as 2.4 units/ac, Value as $407,000 and Age as 18.3 years. This step is analogous to your eye noting a

color pattern of green, red, and green.

The other speared location at Point #2 locates the least similar data

pattern with housing Density of 4.8 units/ac, Value of $190,000 and Age of 51.2

years— or as your eye sees it, a color pattern of red, green, red.

Figure 13. Conceptually linking geographic space and data

space.

The right side of the figure schematically depicts

how the computer determines similarity in the data patterns by analyzing them

in three-dimensional “data space.”

Similar data patterns plot close to one another with increasing distance

indicating decreasing similarity. The

realization that mapped data can be expressed in both geographic space and data

space is paramount to understanding how a computer quantitatively analyses

numerical relationships among mapped data.

The right side of the figure schematically depicts

how the computer determines similarity in the data patterns by analyzing them

in three-dimensional “data space.”

Similar data patterns plot close to one another with increasing distance

indicating decreasing similarity. The realization

that mapped data can be expressed in both geographic space and data space is

paramount to understanding how a computer quantitatively analyses numerical

relationships among mapped data.

Geographic space

uses earth coordinates, such as latitude and longitude, to locate things in the

real world. The geographic expression of

the complete set of measurements depicts their spatial distribution in familiar

map form. Data space, on the other hand, is a bit less familiar. While you can’t stroll through data space you

can conceptualize it as a box with a bunch of balls floating within it.

In the example, the three axes defining the extent

of the box correspond to housing Density (D), Value (V) and Age (A). The floating balls represent data patterns of

the grid cells defining the geographic space—one “floating ball” (data point)

for each grid cell. The data values

locating the balls extend from the data axes—2.4, 407.0 and 18.3 for the comparison

point identified in figure 2. The

other point has considerably higher values in D and A with a much lower V

values so it plots at a different location in data space (4.8, 51.2 and 190.0

respectively).

The bottom line for data space analysis is that the

position of a point in data space identifies its numerical pattern—low, low,

low in the back-left corner, and high, high, high in the upper-right corner of

the box. Points that plot in data space

close to each other are similar; those that plot farther away are less

similar. Data distance is the way

computers “see” what you see in the map displays. The real difference in the graphical and

quantitative approaches is in the details—the tireless computer “sees” subtle

differences between all of the data points and can generate a detailed map of

similarity.

In the example in figure 13, the floating ball

closest to you is least similar—greatest “data distance” from the comparison

point. This distance becomes the

reference for “most different” and sets the bottom value of the similarity

scale (0% similar). A point with an

identical data pattern plots at exactly the same position in data space

resulting in a data distance of 0 equating to the highest similarity value

(100% similar).

Figure 14. A similarity map identifies how related

locations are to a given point.

The similarity map shown in figure 14 applies a

consistent scale to the data distances calculated between the comparison point

and all of the other points. The green

tones indicate locations having fairly similar D, V and A levels to the

comparison location—with the darkest green identifying locations with an

identical data pattern (100% similar).

It is interesting to note that most of the very similar locations are in

the southern portion of the project area.

The light-green to red tones indicate increasingly dissimilar areas

occurring in the northern portion of the project area.

A similarity map can be an extremely valuable tool

for investigating spatial patterns in a complex set of mapped data. The similarity calculations can handle any

number of input maps, yet humans are unable to even conceptualize more than

three variables (data space box). Also,

the different map layers can be weighted to reflect relative importance in

determining overall similarity. For

example, housing Value could be specified as ten times more important in

assessing similarity. The result would

be a different map than the one shown in figure 14— how different depends on

the unique coincidence and weighting of the data patterns themselves.

In effect, a similarity map replaces a lot of

general impressions and subjective suggestions for comparing maps with an

objective similarity measure assigned to each map location. The technique moves map analysis well beyond

traditional visual/visceral map interpretation by transforming digital map

values into to a quantitative/consistent index of percent similarity. Just click on a location and up pops a map

that shows how similar every other location is to the data pattern at the

comparison point— an unbiased appraisal of similarity.

Identifying Data Zones

The previous section introduced the concept of Data

Distance as a means to measure data pattern similarity within a stack of

map layers. One simply mouse-clicks on a

location, and all of the other locations are assigned a similarity value from 0

(zero percent similar) to 100 (identical) based on a set of specified map

layers. The statistic replaces difficult

visual interpretation of a series of side-by-side map displays with an exact

quantitative measure of similarity at each location.

An extension to the technique allows you to circle

an area then compute similarity based on the typical data pattern within the

delineated area. In this instance, the

computer calculates the average value within the area for each map layer to

establish the comparison data pattern, and then determines the normalized data

distance for each map location. The

result is a map showing how similar things are throughout a project area to the

area of interest.

The link between Geographic Space and Data

Space is the keystone concept. As

shown in figure 15, spatial data can be viewed as either a map, or a

histogram. While a map shows us “where

is what,” a histogram summarizes “how often” data values occur

(regardless where they occur). The

top-left portion of the figure shows a 2D/3D map display of the relative

housing density within a project area.

Note that the areas of high housing Density along the northern edge

generally coincide with low home Values.

The histogram in the center of the figure depicts a

different perspective of the data.

Rather than positioning the measurements in geographic space it

summarizes the relative frequency of their occurrence in data space. The X-axis of the graph corresponds to the

Z-axis of the map—relative level of housing Density. In this case, the spikes in the graph

indicate measurements that occur more frequently. Note the relatively high occurrence of

density values around 2.6 and 4.7 units per acre. The left portion of the figure identifies the

data range that is unusually high (more than one standard deviation above the

mean; 3.56 + .80 = 4.36 or greater) and mapped onto the surface as the peak in

the NE corner. The lower sequence of

graphics in the figure depicts the histogram and map that identify and locate

areas of unusually low home values.

Figure 15. Identifying areas of unusually high

measurements.

Figure 16 illustrates combining the housing Density

and Value data to locate areas that have high measurements in both. The graphic in the center is termed a Scatter

Plot that depicts the joint occurrence of both sets of mapped data. Each ball in the scatter plot schematically

represents a location in the field. Its

position in the scatter plot identifies the housing Density and home Value

measurements for one of the map locations—10,000 in all for the actual example

data set. The balls shown in the light

green shaded areas of the plot identify locations that have high Density or

low Value; the bright green area in the upper right corner of the plot

identifies locations that have high Density and low Value.

Figure 16. Identifying joint coincidence in both data

and geographic space.

The aligned maps on the right side of figure 16

show the geographic solution for the high D and low V areas. A simple map-ematical way to generate

the solution is to assign 1 to all locations of high Density and Value map

layers (green). Zero (grey) is assigned

to locations that fail to meet the conditions.

When the two binary maps (0 and1) are multiplied, a zero on either map

computes to zero. Locations that meet

the conditions on both maps equate to one (1*1 = 1). In effect, this “level-slice” technique

locates any data pattern you specify—just assign 1 to the data interval of

interest for each map variable in the stack, and then multiply.

Figure 17 depicts level slicing for areas that are

unusually low housing Density, high Value and low Age. In this instance the data pattern coincidence

is a box in 3-dimensional scatter plot space (upper-right corner toward the

back). However a slightly different map-ematical

trick was employed to get the detailed map solution shown in the figure.

Figure 17. Level-slice classification using three map

variables.

On the individual maps, areas of high Density were

set to D= 1, low Value to V= 2 and high Age to A= 4, then the binary map layers

were added together. The result is a range

of coincidence values from zero (0+0+0= 0; gray= no coincidence) to seven

(1+2+4= 7; dark red for location meeting all three criteria). The map values in between identify the areas

meeting other combinations of the conditions.

For example, the dark blue area contains the value 3 indicating high D

and low V but not high A (1+2+0= 3) that represents about three percent of the

project area (327/10000= 3.27%). If four

or more map layers are combined, the areas of interest are assigned increasing

binary progression values (…8, 16, 32, etc)—the sum will always uniquely

identify all possible combinations of the conditions specified.

While level-slicing isn’t a very sophisticated

classifier, it illustrates the usefulness of the link between Data Space and Geographic

Space to identify and then map unique combinations of conditions in a set of

mapped data. This fundamental concept

forms the basis for more advanced geo-statistical analysis—including map

clustering that will be the focus of next section.

Mapping Data Clusters

The last couple of

sections have focused on analyzing data similarities within a stack of

maps. The first technique, termed Map

Similarity, generates a map showing how similar all other areas are to a

selected location. A user simply clicks

on an area and all of the other map locations are assigned a value from zero

(0% similar—as different as you can get) to one hundred (100% similar—exactly

the same data pattern).

The other technique, Level

Slicing, enables a user to specify a data range of interest for each map

layer in the stack then generate a map identifying the locations meeting the

criteria. Level Slice output identifies

combinations of the criteria met—from only one criterion (and which one it is),

to those locations where all of the criteria are met.

While both of these

techniques are useful in examining spatial relationships, they require the user

to specify data analysis parameters. But

what if you don’t know which locations in a project area warrant Map Similarity

investigation or what Level Slice intervals to use? Can the computer on its own identify groups

of similar data? How would such a

classification work? How well would it

work?

Figure 18 shows some

example spatial patterns derived from Map Clustering. The “floating” map layers on the left show

the input map stack used for the cluster analysis. The maps are the same ones used in previous

examples and identify the geographic and numeric distributions of housing Density,

home Value and home Age levels throughout the example project area.

Figure

18. Example output from map clustering.

The map in the center of

the figure shows the results of classifying the D, V and A map stack into two

clusters. The data pattern for each cell

location is used to partition the field into two groups that are 1) as different

as possible between groups and 2) as similar as possible within

a group. If all went well, any other

division of the mapped data into two groups would be worse at mathematically balancing

the two criteria.

The two smaller maps on

the right show the division of the data set into three and four clusters. In all three of the cluster maps, red is

assigned to the cluster with relatively high Density, low Value and high Age

responses (less wealthy) and green to the one with the most opposite conditions

(wealthy areas). Note the encroachment

at the margin on these basic groups by the added clusters that are formed by

reassigning data patterns at the classification boundaries. The procedure is effectively dividing the

project area into “data neighborhoods” based on relative D, V and A values

throughout the map area. Whereas

traditional neighborhoods usually are established by historical legacy, cluster

partitions respond to similarity of mapped data values and can be useful in

establishing insurance zones, sales areas and marketing clusters.

The mechanics of

generating cluster maps are quite simple.

Just specify the input maps and the number of clusters you want then

miraculously a map appears with discrete data groupings. So how is this miracle performed? What happens inside clustering’s black box?

Figure

19. Data patterns for map locations are

depicted as floating balls in data space with groups of nearby patterns

identifying data clusters.

The schematic in figure

19 depicts the process. The floating balls

identify the data pattern for each map location (in Geographic Space) plotted

against the P, K and N axes (in Data Space).

For example, the tiny green ball in the upper-right corner corresponds

to a map location in the wealthiest part of town (low D, high V and low

A). The large red ball appearing closest

depicts a location in a less wealthy part (high D, low V and high A). It seems sensible that these two extreme

responses would belong to different data groupings (clusters 1 and 2,

respectively).

While the specific

algorithm used in clustering is beyond the scope of this discussion (see

author’s note), it suffices to recognize that data distances between the

floating balls are used to identify cluster membership— groups of balls that

are relatively far from other groups (different between groups) and

relatively close to each other (similar within a group) form separate data

clusters. In this example, the red balls

identify relatively less wealthy locations while green ones identify wealthier

locations. The geographic pattern of the

classification (wealthier in the south) is shown in the 2D maps in the lower

right portion of the figure.

Identifying groups of

neighboring data points to form clusters can be tricky business. Ideally, the clusters will form distinct

“clouds” in data space. But that rarely

happens and the clustering technique has to enforce decision rules that slice a

boundary between nearly identical responses.

Also, extended techniques can be used to impose weighted boundaries based

on data trends or expert knowledge.

Treatment of categorical data and leveraging spatial autocorrelation are

additional considerations.

So how do know if the

clustering results are acceptable? Most

statisticians would respond, “…you can’t tell for sure.” While there are some elaborate procedures

focusing on the cluster assignments at the boundaries, the most frequently used

benchmarks use standard statistical indices, such as T- and F-statistics used

in comparing sample populations.

Figure 20 shows the

performance table and box-and-whisker plots for the map containing two data

clusters. The average, standard

deviation, minimum and maximum values within each cluster are calculated. Ideally the averages between the two clusters

would be radically different and the standard deviations small—large difference

between groups and small differences within groups.

Figure

20. Clustering results can be evaluated

using “box and whisker” diagrams and basic statistics.

Box-and-whisker plots

enable us to visualize these differences.

The box is aligned on the Average (center of the box) and extends above

and below one Standard Deviation (height of the box) with the whiskers drawn to

the minimum and maximum values to provide a visual sense of the data range. If the plots tend to overlap a great deal, it

suggests that the clusters are not very distinct and indicates significant

overlapping of data patterns between clusters.

The separation between

the boxes in all three of the data layers of the example suggests good

distinction between the two clusters with the Home Value grouping the best with

even the Min/Max whiskers not overlapping.

Given the results, it appears that the clustering classification in the

example is acceptable… and hopefully the statisticians among us will accept in advance

my apologies for such an introductory and visual treatment of a complex topic.

Mapping the Future

For years non-spatial statistics has been

predicting things by analyzing a sample set of data for a numerical

relationship (equation) then applying the relationship to another set of

data. The drawbacks are that a

non-spatial approach doesn’t account for geographic patterns and the result is

just summary of the overall relationship for an entire project area.

Extending predictive analysis to mapped data seems

logical as maps at their core are just organized sets of numbers and the GIS

toolbox enables us to link the numerical and geographic distributions of the

data. The past several columns have

discussed how the computer can “see” spatial data relationships including

“descriptive techniques” for assessing map similarity, data zones,

and clusters. The next logical

step is to apply “predictive techniques” that generates mapped forecasts of

conditions for other areas or time periods.

To illustrate the process, suppose a bank has a

database of home equity loan accounts they have issued over several

months. Standard geo-coding techniques

are applied to convert the street address of each sale to its geographic

location (latitude, longitude). In turn,

the geo-tagged data is used to “burn” the account locations into an analysis

grid as shown in the lower left corner of figure 21. A roving window is used to derive a Loan

Concentration surface by computing the number of accounts within a specified

distance of each map location. Note the

spatial distribution of the account density— a large pocket of accounts in the

southeast and a smaller one in the southwest.

Figure 21. A loan concentration surface is created by

summing the number of accounts for each map location within a specified

distance.

The most frequently used method for establishing a quantitative

relationship among variables involves Regression. It is beyond the scope of this column to

discuss the underlying theory of regression; however in a conceptual nutshell,

a line is “fitted” in data space that balances the data so the differences from

the points to the line (termed the residuals) are minimized and the sum of the

differences is zero. The equation of the

best-fitted line becomes a prediction equation reflecting the spatial

relationships among the map layers.

To illustrate predictive modeling, consider the

left side of figure 22 showing four maps involved in a regression

analysis. The loan Concentration surface

at top is serves as the Dependent Map Variable (to be predicted). The housing Density, Value, and Age surfaces

serve as the Independent Map Variables (used to predict). Each grid cell contains the data values used

to form the relationship. For example,

the “pin” in the figure identifies a location where high loan Concentration

coincides with a low housing Density, high Value and low Age response

pattern.

Figure 22. Scatter plots and regression results relate

Loan Density to three independent variables (housing Density, Value and Age).

The scatter plots in the center of the figure

graphically portray the consistency of the relationships. The Y axis tracks the dependent variable

(loan Concentration) in all three plots while the X axis follows the independent

variables (housing Density, Value, and Age).

Each plotted point represents the joint condition at one of the grid

locations in the project area—10,000 dots in each scatter plot. The shape and orientation of the cloud of

points characterizes the nature and consistency of the relationship between the

two map variables.

A plot of a perfect relationship would have all of

the points forming a line. An upward

directed line indicates a positive correlation where an increase in X

always results in a corresponding increase in Y. A downward directed line indicates a

negative correlation with an increase in X resulting in a

corresponding decrease in Y. The slope

of the line indicates the extent of the relationship with a 45-degree slope

indicating a 1-to-1 unit change. A

vertical or horizontal line indicates no correlation— a change in one

variable doesn’t affect the other.

Similarly, a circular cloud of points indicates there isn’t any

consistency in the changes.

Rarely does the data plot into these ideal

conditions. Most often they form

dispersed clouds like the scatter plots in figure 22. The general trend in the data cloud indicates

the amount and nature of correlation in the data set. For example, the loan Concentration vs.

housing Density plot at the top shows a large dispersion at the lower housing

Density ranges with a slight downward trend.

The opposite occurs for the relationship with housing Value (middle

plot). The housing Age relationship

(bottom plot) is similar to that of housing Density but the shape is more

compact.

Regression is used to quantify the trend in the

data. The equations on the right side of

figure 22 describe the “best-fitted” line through the data clouds. For example, the equation Y= 26.0 – 5.7X

relates loan Concentration and housing Density.

The loan Concentration can be predicted for a map location with a

housing Density of 3.4 by evaluating Y= 26.0 – (5.7 * 3.4) = 6.62 accounts

estimated within .75 miles. For

locations where the prediction equation drops below 0 the prediction is set to

0 (infeasible negative accounts beyond housing densities of 4.5).

The “R-squared index” with the regression equation

provides a general measure of how good the predictions ought to be— 40%

indicates a moderately weak predictor. If

the R-squared index was 100% the predicting equation would be perfect for the

data set (all points directly falling on the regression line). An R-squared index of 0% indicates an

equation with no predictive capabilities.

In a similar manner, the other independent

variables (housing Value and Age) can be used to derive a map of expected loan

Concentration. Generally speaking it

appears that home Value exhibits the best relationship with loan Concentration

having an R-squared index of 46%. The

23% index for housing Age suggests it is a poor predictor of loan

Concentration.

Multiple regression can be used to simultaneously

consider all three independent map variables as a means to derive a better

prediction equation. Or more

sophisticated modeling techniques, such as Non-linear Regression and

Classification and Regression Tree (CART)

methods, can be used that often results in an R-squared index exceeding 90%

(nearly perfect).

The bottom line is that predictive modeling using

mapped data is fueling a revolution in sales forecasting. Like parasailing on a beach, spatial data

mining and predictive modeling are affording an entirely new perspective of

geo-business data sets and applications by linking data space and geographic

space through grid-based map analysis.

Mapping Potential Sales

My first sojourn into geo-business involved an

application to extend a test marketing project for a new phone product

(nick-named “teeny-ring-back”) that enabled two phone numbers with distinctly different

rings to be assigned to a single home phone—one for the kids and one for the

parents. This pre-Paleolithic project

was debuted in 1991 when phones were connected to a wall by a pair of copper

wires and street addresses for customers could be used to geo-code the actual

point of sale/use. Like pushpins on a

map, the pattern of sales throughout the city emerged with some areas doing

very well (high sales areas), while in other areas sales were few and far between

(low sales areas).

The assumption of the project was that a

relationship existed between conditions throughout the city, such as income

level, education, number in household, etc. could help explain sales

pattern. The demographic data for the

city was analyzed to calculate a prediction equation between product sales and

census data.

The prediction equation derived from test market

sales in one city could be applied to another city by evaluating exiting

demographics to “solve the equation” for a predicted sales map. In turn, the predicted sales map was combined

with a wire-exchange map to identify switching facilities that required

upgrading before release of the product in the new city. Although GIS systems were crude at the time,

the project was deemed a big success.

Now fast-forward to more contemporary times. A GeoWorld feature article described a

similar, but much more thorough analysis of retail sales competition (Beyond

Location, Location, Location: Retail Sales Competition Analysis, www.innovativegis.com/basis/present/GW06_retail/GW06_Retail.htm;

GeoWorld, March 2006). Figure 23

outlines the steps for determining competitive advantage for various store

locations.

Most

Figure 23. Spatial Modeling

steps derive the relative travel time relationships for our store and each of

the competitor stores for every location in the project area and links this

information to customer records.

Figure 24. Predictive Modeling steps use spatial data

mining procedures for relating spatial and non-spatial factors to sales data to

derive maps of expected sales for various products.

Step 1 map shows the grid-based solution for

travel-time from “Our Store” to all other grid locations in the project

area. The blue tones identify grid cells

that are less than twelve minutes away assuming travel on the highways is four

times faster than on city streets. Note

the star-like pattern elongated around the highways and progressing to the

farthest locations (warmer tones). In a

similar manner, competitor stores are identified and the set of their travel

time surfaces forms a series of geo-registered maps supporting further analysis

(Step 2).

Step 3 combines this information for a series of

maps that indicate the relative cost of visitation between our store and each

of the competitor stores (pair-wise comparison as a normalized ratio). The

derived “Gain” factor for each map location is a stable, continuous variable

encapsulating travel-time differences that is suitable for mathematical

modeling. A Gain of less than 1.0

indicates the competition has an advantage with larger values indicating

increasing advantage for our store. For

example, a value of 2.0 indicates that

there is a 200% lower cost of visitation to our store over the competition.

Figure 24 summarizes the

predictive modeling steps involved in competition analysis of retail data. The geo-coding link between the analysis

frame and a traditional customer dataset containing sales history for more than

80,000 customers was used to append travel-times and Gain factors for all

stores in the region (Step 4).

The regression hypothesis

was that sales would be predictable by characteristics of the customer in

combination with the travel-time variables (Step 5). A series of mathematical models are built

that predict the probability of purchase for each product category under

analysis. This provides a set of model

scores for each customer in the region.

Since a number of customers could be found in many grid cells, the

scores were averaged to provide an estimate of the likelihood that a person

from each grid cell would travel to our store to purchase one of the analyzed

products. The scores for each product

are mapped to identify the spatial distribution of probable sales, which in

turn can be “mined” for pockets of high potential sales.

Figure 25. Map Analysis exploits

the digital nature of modern maps to examine spatial patterns and relationships

within and among mapped data.

Targeted marketing,

retail trade area analysis, competition analysis and predictive modeling

provide examples applying sophisticated Spatial Analysis and Spatial

Statistics to improve decision making.

The techniques described in the past nine sections have focused on Map

Analysis— procedures that extend traditional mapping and geo-query to

map-ematically based analysis of mapped data.

Figure 25 outlines the classes of operations described in the series

(blue highlighted techniques were specifically discussed).

Conclusion

Recall that the keystone

concept is an Analysis Frame of grid cells that provides for tracking

the continuous spatial distributions of mapped variables and serves as the

primary key for linking spatial and non-spatial data sets. While discrete sets of points, lines and

polygons have served our mapping demands for over 8,000 years and keep us from

getting lost, the expression of mapped data as continuous spatial distributions

(surfaces) provides a new foothold for the contextual and numerical analysis of

mapped data— in many ways, “thinking with maps” is more different than it is

similar to traditional mapping.

References

Analyzing Geo-Business Data

by Joseph K. Berry (2003; BASIS Press) …a

case study

in Spatial Analysis and Data Mining in Business with software, database and

“hands-on” exercises (US$45; www.innovativegis.com/basis/Books/AnalyzingGBdata/)

Map

Analysis

by Joseph K. Berry (2007; GeoTec Media) …provides

a structured view of grid-based map analysis and GIS modeling with software, database and “hands-on” exercises (US$45; www.innovativegis.com/basis/Books/MapAnalysis/)

Also

see the online book Beyond Mapping III by Joseph K. Berry (BASIS Press) that is posted at

…select

the following topics for more information on grid-based map analysis and

procedures described in this paper:

¾

Topic 7, Linking Data Space and Geographic Space

¾

Topic 10, Analyzing Map Similarity and Zoning

¾

Topic 14, Deriving and Using Travel-Time Maps

¾

Topic 16, Characterizing Patterns and Relationships

¾

Topic 18, Understanding Grid-based Data

¾

Topic 22, Overview of Spatial Analysis and Statistics

¾

Topic 28, Spatial Data Mining in Geo-Business

_______________________________

1 Dr. Berry is the Principal of Berry and Associates // Spatial

Information Systems (BASIS),

consultants and software developers in

2 Dr.

Reed is with Xtreme Data Mining. Prior to this position he was an Associate

Partner with Accenture and head of their retail sales modeling group with

customers throughout the world. His

geo-business projects have extended from analyzing in-store shopping patterns

to modeling sales potential throughout large metropolitan areas.