GeoWorld Articles

|

Further Understanding Spatial Patterns and Relationships ( |

Feature

article for GeoWorld, March 2006, Vol. 19, No. 3, pgs. 22-25

<Click here>

right-click for a printer-friendly version of this paper (.pdf).

Beyond Location, Location, Location: Retail

Sales Competition Analysis

by Joseph K,

Introduction

For years businesses have generally ignored

spatial relationships in data analysis. While

common sense considers “location, location, location” a cornerstone of

business, traditional analysis procedures force spatial information, such as

customer location, to be aggregated into large generalized reporting units. Pockets of sales on one side of a trade area

are not differentiated from those on another side.

Geo-Business

describes an emerging discipline that uses Geographic Information Systems (

Site

location is an early example of extending these basic mapping capabilities to

map analysis. The application uses

The

latter two of these emerging Geo-business applications, Competition Analysis

and Predictive Modeling, serve as the focus of this paper. The discussion summarizes the primary steps

involved in generating predicted sales maps for various products. The approach

is based on competitor locations to model relative travel-time advantage and

existing customer data to model sales patterns and travel-time

sensitivity. While the experience described

is the result of an ambitious prototype model involving a large metropolitan

area and tens of thousands of customer records, the graphics shown have been

altered and the details of implementation and results are curtailed.

Deriving Travel Time

Maps

Most

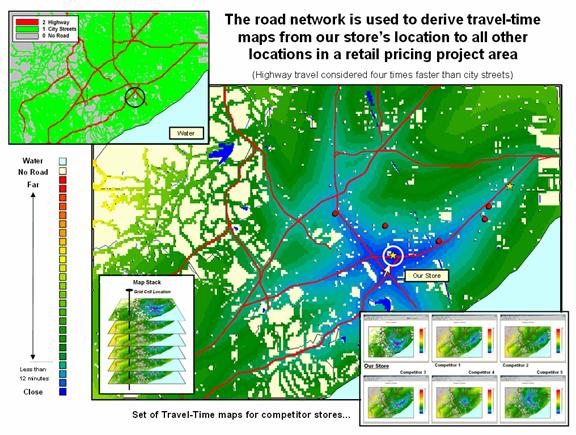

Figure 1.

Grid-based travel time analysis involves calculating effective proximity as a

series of propagating waves that respond to various speeds along the road map

resulting in access zones from close (blue) to far (red).

For

example, the extent of project area shown in figure 1 is an 18 by 23 mile swath

of a major metropolitan area capturing hundreds of thousands of

residences. The inset in the upper left

corner shows primary and secondary roads defining an analysis frame of the area

comprised of four-hectare grid cells within a matrix of 228 columns by 153 rows

(34,884 sample locations). This spatial

resolution is appropriate for strategic-level competition analysis; however a

higher resolution is easily imposed by specifying a smaller grid size during

the vector to raster conversion of the road map.

The

large map in the center depicts the calculated travel time from “Our Store” to

all other grid locations in the project area.

The blue tones identify grid cells that are less than twelve minutes

away assuming travel on the highways is four times faster than on city

streets. Note the star-like pattern

elongated around the highways and progressing to the farthest locations (warmer

tones). Competitor locations are

indicated by the red dots. The tan areas are parks and natural or industrial

locations not served by the road network.

The

grid-based procedure is not as exacting as point-to-point solutions as it

ignores one-way streets, left-turn waits, and other navigational factors;

however the relative access surface it generates is appropriate for competition

analysis (see Authors’ Note 1). In a similar manner, competitor stores are

identified and the set of their travel time surfaces forms a geo-registered map

stack supporting analysis.

Determining Relative

Gain for Stores

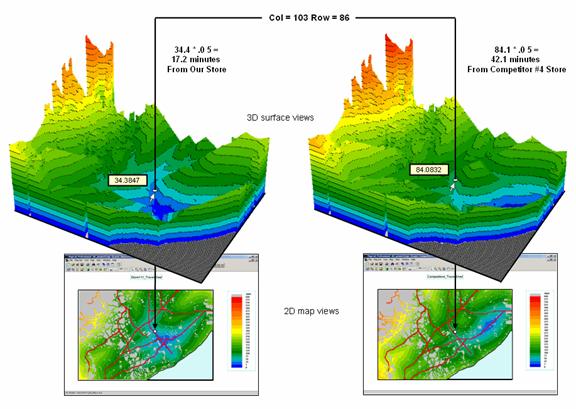

The

travel-time surfaces summarize relative customer access to our store and

competitor stores for all grid locations in the trade area. Figure 2 shows 2D and 3D displays of the

surfaces for our store and competitor #4.

Note that a travel-time surface is shaped like a bowl with the bottom of

the bowl at the store’s location (map value= zero away) and the walls formed by

increasingly larger travel-time values.

For any given location, the two travel-time values for a pair of

surfaces can be easily retrieved and compared by subtracting. In the example, the subject location in the

figure is 17.2 minutes (34.4 cells away * .05 minutes/cell) from our store

versus 42.1 minutes for competitor #4 store—a significant 24.9 minute advantage

for our store.

A

more useful Travel-Time Gain factor for modeling can be derived by evaluating

the grid-math equation,

for

two travel-time maps at every grid location in the project area. The result is a map indicating the relative

cost of visitation choices between the two stores for every grid location. A Gain of less than 1.0 indicates the

competition has an advantage with larger values indicating increasing advantage

for our store. For example, a value of

2.0 indicates that there is a 200%

lower cost of visitation to our store over the competition.

Figure

2. The Travel-time value stored at each grid

location specifies how far away it is from a store—location 103c, 86r is 17.2

minutes away from Our Store and 42.1 minutes away from Competitor #4 Store.

The Gain factor is a stable, continuous variable

encapsulating travel-time differences that is suitable for mathematical

modeling (see Author’s Note 3). A Gain calculation summarizing travel-time

advantages between our store and a competitor store is made for each cell in

the project area. These Gain

calculations are used as input to the sales prediction models reported

below.

Overview of Processing

Steps

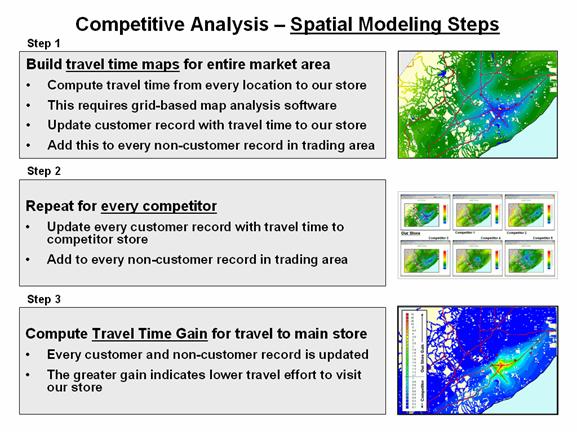

Figure 3a summarizes the

spatial modeling steps involved in competition analysis. The first and second steps use grid-based map

analysis procedures to construct travel-time maps for all stores of interest

within the market area. The third step

generates mapped data of the relative gain for our store and each of the

competitor stores.

Figure 3a.

Spatial Modeling steps derive the relative travel time relationships for our

store and each of the competitor stores for every location in the project area

and links this information to customer records.

Critical throughout these

steps is the use of geo-coding through address-matching to map each person in

the region to a discrete grid cell based on latitude and longitude of their

home street address. This provides a

universal key for transferring and integrating spatial information of

Travel-Time and Gain to and from a database of non-spatial customer information

that can be summed, averaged, counted or otherwise described for each grid cell

and surrounding groups of cells defining town boundaries or sales

districts.

The

Travel-Time Gain data is the cornerstone of competition analysis. It provides a consistent measure of store

competition that can be used in data mining along with traditional non-spatial

variables such as customer sales activity, demographics, economics, life-style and

life-stage information. This link

between spatial and non-spatial information supports the development of

predictive models that consider detailed “location, location, location”

information within traditional data mining procedures.

For the predictive

modeling, we used a regression approached using a specialized data mining

technology, KXEN K2R, based on Vapnik Statistical Learning theory (see

Authors’ Note 3). This commercially

available technology is similar to linear or logistic regression except that

the convergence algorithms are not based on least-squares techniques. A main

advantage is that non-linearity in the continuous input variables are

represented by piece-wise linear terms, rendering hand transforms to add power

terms (e.g. y = a + bx + cx2) unnecessary.

The tool also can

automatically detect and handle multi-colinearity and works with ordinal and

nominal input data as well as continuous variables. It is capable of building excellent models

from very large data sets, with thousands of columns and millions of rows of

data in a single step. These very large

models can be automatically reduced to the minimal set of independent variables

in a second modeling pass where information contribution criteria are applied

to eliminate variables from the equation, in a manner loosely analogous to

stepwise linear regression.

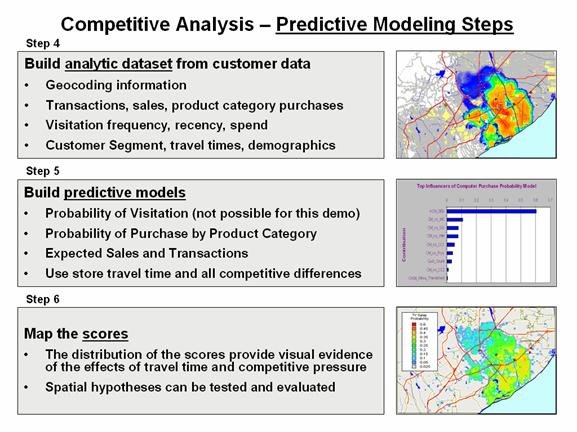

Figure

3b. Predictive Modeling steps use spatial

data mining procedures for relating spatial and non-spatial factors to sales

data to derive maps of expected sales for various products.

Figure 3b summarizes the

predictive modeling steps involved in competition analysis of retail data. For the examples in this paper, a dataset was

developed containing sales history for more than 80,000 customers in the

trading area. Using latitude and longitude of each street address, customers

were geo-coded to the map and the grid row and column coordinates assigned by

membership within the latitude and longitude coordinates of a grid cell. Thus each consumer was assigned to a grid

cell location, for which the travel-times to all stores in the region were

known. The regression hypothesis was

that sales would be predictable by characteristics of the customer in

combination with the travel-time variables.

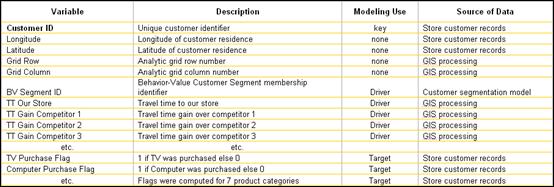

A summary of the dataset

records used to develop the predictive models is shown in Table 1. The first five entries identify a customer

and their derived grid cell location in the analysis grid. The next several entries are derived factors

including non-spatial Customer Segment assignment and spatial Travel-time and

Gain factors that are used as drivers by the prediction model. The remaining entries are target variables.

Table

1. Description of record types in the

combined spatial and non-spatial data set for predictive modeling.

In Step 5 of figure 3b, a

series of mathematical models are built that predict the probability of

purchase for each product category under analysis. This provides a set of model scores for each

customer in the region. Non-customers

could be scored with these models, but that was beyond the scope of the

demonstration project. Since a number of

customers could be found in most grid cells, the scores were averaged to

provide an estimate of the likelihood that a person from each grid cell would

travel to our store to purchase one of the analyzed products.

Specifically, purchase

probabilities for seven product categories were modeled for each grid

cell. The final step in the process

simply maps the scores for visual analysis or subsequent analysis, such

targeted marketing.

Example Results

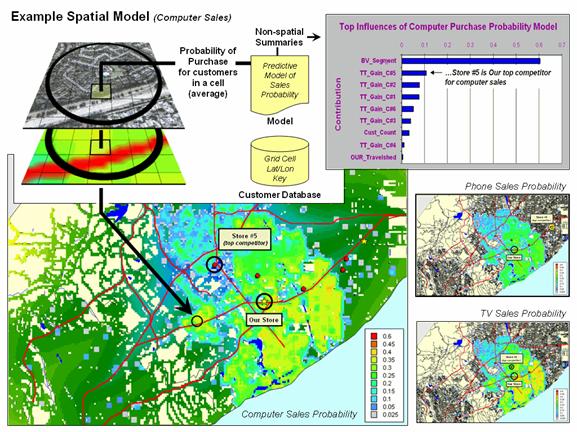

The

upper right inset in figure 4 summarizes the processing flow for mapping the

probability of purchase. An analysis

dataset is constructed containing customer data, geographic location and

derived spatial and non-spatial variables used in predictive modeling. The probability of purchasing a specified

product is derived for each customer and the individual probabilities in a grid

cell are averaged, then the resulting map is displayed.

Note

in the example that the non-spatial summaries identifies that the most

important variable in the model is the derived Customer Segmentation

grouping. The next most import variable

is the Gain Factor for competitor #5, identifying that for Computer Sales this

store represents our greatest competition.

This is somewhat counter intuitive as the map of computer sales

probability shows this store fairly far away and in an area of only moderate TV

sales probability. It suggests that

customers are somewhat more elastic toward travel for computer purchases than

Phone or TV purchases as shown in the two smaller maps on the right.

Figure

4. Mapping the results of the prediction

models provides insight into the level and geographic distribution of probable

sales, as well as the competitor environment.

The

information on the level of probable sales, its distribution throughout the

trade area and competitor environment can be invaluable in marketing decisions

and developing strategies for product mix and sales emphasis.

Conclusion

Several

summary and concluding points can be made—

-

Historically

spatial information has been ignored or at least aggregated to effectively

non-spatial levels

-

Grid-based

map analysis provides a consistent base unit (grid cell) for calculating

spatial context and facilitating the linkage of

-

Travel-time

and its derivative Gain Factor summarize the relative access cost for customers

between stores

-

Spatial Modeling provides a new dimension to

customer understanding

-

Sales can be related to Competitors as well as

Customer Segments and groups

-

New customer acquisition targeting can take spatial

factors into account

-

Specific product categories have very different

spatial distributions

-

Competitive factors can be discovered and managed

-

Sales potential modeling/mapping identifies

opportunities by product supporting target marketing, and

-

Store placement can leveraged through better

understanding of competitive and customer positioning.

“Location,

location, location” is a cornerstone of the business environment. The potential of the convergence of spatial

and non-spatial information in data mining and predictive modeling is

great. As business interests and

_____________________________

Authors’

Notes:

1) For more information

about travel-time calculations and applications in geo-business see www.innovativegis.com/basis/,

select the Map Analysis online book, Topic 14, “Deriving and Using Travel-time

Maps.”

2) For some purposes, it might be useful to

transform the Gain equation to a logarithmic form (log(Gain)) that would

linearize the function and perhaps better represent areas where competitor has

an advantage.

3) For more information

on the Knowledge Extraction Engines (Kxen) spatial data mining technology used

in developing the predictive models see www.kxen.com/news/2003/12/veolia_water_systems.php

__________________________________

Joseph K,

Keck Scholar in

Geosciences,

Kenneth L. Reed

Senior Director of

Business Analytics, LowerMyBills.com